Academics in Harper Adams University’s Rural Resilience Research Group (3RG) are working to provide analysis of food security issues around the world.

The group is the successor of the Rural Security Research Group (RSRG) that has been operating at Harper Adams for around a decade, with a focus on rural, agricultural and farm crime.

As academics’ research has developed, it became clear the real strength of the team is that it looks beyond the criminal act to consider the impact on the whole farm system and importantly the second and third order effects that emanate from a shock such as mental health and food security.

This widened focus has also seen the team lend its weight to a series of open-source briefings for officials and ministers in Whitehall – with the first such briefing, for the week ending May 5, reproduced below – and further briefings to follow on the Harper Adams blog throughout the coming year.

Despite the war in Ukraine, the market is seeing ample supplies of grains in the system and the improving prospects in the US are keeping grain prices low although it seems to be not factoring in the fundamentals and vagaries of grain production.

The near future supply is never 100 per cent certain given climatic variables.

While the news from the US is welcome, there remains an on-going drought which is impacting up to 21 per cent of spring wheat and 28 per cent of corn/maize. Latest indications are that less than 30 per cent of US Winter Wheat is classed as good/excellent condition, and the proportion of poor/failed crops is rising.

Additionally, while EU crops are currently good, long range weather forecasts are indicating summer dryness, which may yet impact yield. We have already experience unseasonably high temperatures in Spain, which are causing concern for a variety of growers.

Disputes between Poland, Hungary, Romania and Ukraine over grains moving into their territorial markets has led to a ban on imports into ‘frontline’ states while grains can still be released for sale in the rest of the EU and for export to the world market.

The Black Sea Grain Initiative, a deal brokered between Ukraine, Russia, Turkey and the UN, has come into sharp focus with Russia accusing the deal of failing to address Russia’s export requirements, in particular reconnection to the SWIFT payment system. Renegotiation of the deal is due to start in a few weeks, with Ukraine accusing Russia of deliberately slowing down shipping on the grain corridor with slow inspections.

In North Africa, the Egyptian Government has stated that the country as over two months of wheat stockpile but is considering buying wheat in Indian and/or Chinese currency. Morocco which has been badly impacted by extreme climatic conditions the last few years is looking to boost grain production by 62 per cent this year, although many areas are very dry.

In West Africa, there are some 45,000 people at risk of starvation in Burkino Faso’s Sahel region, as people are under blockade by non-state armed groups. While the fighting in Sudan is generating increasing numbers of refugees, with more than 1000 people arriving in Ethiopia from Sudan daily, the rest heading to Egypt and being internally displaced. Agencies are planning for up to 860,000 people being displaced, with food systems badly disrupted and the Port of Sudan now joining the list of shipping areas where war premiums are applied for insurance there are increasing concerns for the welfare of the population. The fighting in Sudan is now impacting traffic into the Central African Republic, severely disrupting food supplies leading to a doubling of some basic foodstuffs. The Central African Republic already has acute food insecurity status.

India’s harvest is under way and the Government is purchasing wheat at a faster rate than for some years to replenish it depleted stockpile. A good harvest will pave the way for a restart to wheat and rice exports, which will hopefully cool prices in SE Asian countries.

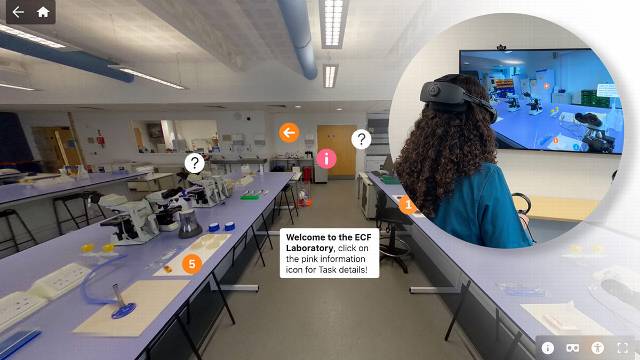

Blog: Veterinary Medicine students step into immersive 360° laboratory

At Harper & Keele Veterinary School, students are stepping beyond the traditional microbiology bench and into an immersive 360° labo …

Posted

Yesterday

Blog: Veterinary Medicine students step into immersive 360° laboratory

At Harper & Keele Veterinary School, students are stepping beyond the traditional microbiology bench and into an immersive 360° labo …

Posted

Yesterday