Academics in Harper Adams University’s Rural Resilience Research Group (3RG) are working to provide analysis of food security issues around the world.

The group is the successor of the Rural Security Research Group (RSRG) that has been operating at Harper Adams for around a decade, with a focus on rural, agricultural and farm crime.

As academics’ research has developed, it became clear the real strength of the team is that it looks beyond the criminal act to consider the impact on the whole farm system and importantly the second and third order effects that emanate from a shock such as mental health and food security.

This widened focus has also seen the team lend its weight to a series of open-source briefings for officials and ministers in Whitehall - the latest of which we reproduce here.

The market is still seeing ample grain supplies in the system and prices across commodities remain low.

One of the two big factors in pricing, the Black Sea Grain Initiative (BSGI) is being seen as less important by the market for food security so is being priced out.

This is a result of recent rains in the US and the French wheat crop being in a good stable condition, an improvement in Argentina wheat and a bumper Chinese wheat crop, which the market believes will take pressure off exports, particularly from Ukraine, Australia and the US.

However, the much-needed rains in the US are likely to have come too late for many grain producing states - and indeed, in too large a quantity, flooding fields and drowning crops.

Kansas, a large US wheat producing state, has abandoned crops following extreme drought.

Around 70 per cent of US winter wheat is classed as being in a poor condition, while extreme dryness continues in the east of the country impacting maize/ corn and soyabean planting.

In Europe the extreme rainfall of the last two weeks has impacted crops in Italy particularly badly, leading to losses of Durum wheat as well as destroying farmland. There are also reports of heavy rainfall and flooding impacting the Chinese crop.

Most concerning is the probable arrival of El Niño - which will likely bring higher temperatures.

There are also reports of ocean temperatures spiking, both in the north Pacific and the Atlantic, which may combine with El Niño to bring disruptive weather patterns, especially to Atlantic Europe, South America and Western North America.

Across the board the market is looking to an increased harvest as per the FAO estimate.

However, it is increasingly likely that extreme weather will impact harvest and quality.

Extreme rainfall close to harvest, which China is experiencing, not only physically damages crops and encourages molds, it also ‘washes’ out protein making it less useful for bread and noodle making.

Chinese weather-related crop loss could see China return to the market with disruptive purchasing. Given that Ukraine’s crop currently is in good condition, and it will have some exportable surplus, the Black Sea Grain Initiative could yet become key to food security.

The latest FAO hunger warning highlights acute hunger developing in Sudan due to conflict and Afghanistan, Pakistan, Nigeria and Somalia for a combination of security, climate and economic issues.

Despite efforts to boost producing, drought has impacted Tunisian production meaning it is highly likely they will have to utilised their national stockpile and return to the market.

Egypt, which has publicly stated it has food reserves just short of six months, has now deferred payment for wheat imports due to lack of foreign currency.

Despite a good harvest in India, the government’s wheat procurement plan to re-stock the food reserve has fallen short by 25 per cent. This has resulted in the continuation of the what export ban to protect domestic prices. The new crop is also under threat from extreme weather. As a result of rising prices, way above the government buy-in price for the reserve, farmers are holding onto crops in the hope of higher prices. This is consequently pushing up food prices.

There is realistic probability that at some point in the next three to six months, India will have to turn to the market to control domestic wheat prices. The continuation of the export ban means price pressure on the Asian market goes on.

(Editor's note - this blog was prepared before the breaching of the Nova Kakhovka dam in Ukraine.)

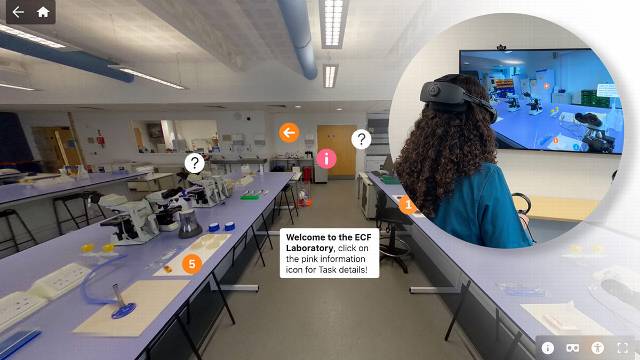

Blog: Veterinary Medicine students step into immersive 360° laboratory

At Harper & Keele Veterinary School, students are stepping beyond the traditional microbiology bench and into an immersive 360° labo …

Posted

Yesterday

Blog: Veterinary Medicine students step into immersive 360° laboratory

At Harper & Keele Veterinary School, students are stepping beyond the traditional microbiology bench and into an immersive 360° labo …

Posted

Yesterday