Academics in Harper Adams University’s Rural Resilience Research Group (3RG) are working to provide analysis of food security issues around the world.

The group is the successor of the Rural Security Research Group (RSRG) that has been operating at Harper Adams for around a decade, with a focus on rural, agricultural and farm crime.

As academics’ research has developed, it became clear the real strength of the team is that it looks beyond the criminal act to consider the impact on the whole farm system and importantly the second and third order effects that emanate from a shock such as mental health and food security.

This widened focus has also seen the team lend its weight to a series of open-source briefings for officials and ministers in Whitehall - the latest of which we reproduce here.

As the northern hemisphere harvest gets underway there is a lot of uncertainty and potential volatility, principally due to weather uncertainties as well as geopolitical issues.

Rains in northern Europe and the US have eased the soyabeans and corn (maize) futures markets, while concerns about wheat, both in the EU and the US have kept prices firm.

Prices are thought to be suppressed by a negative economic outlook which is feeding into the demands side. A slowdown in the global economy will impact demand for dairy, meat and also ‘discretionary' products, such as cakes and biscuits.

Weather is now the key driver, and although the market is dismissing concerns of supply side issues with the maintenance of low prices, this could likely change, and change quickly, as the harvest in the EU and US begin. In the EU here are concerns not just about the French crop, but also the German and Baltic region.

The EU crop monitor has cut the 2023 grain yield across most cereal crops, although most stay within a five-year average. In the US there are many reports of browning and stressed crops, and also a decline in grazing quality due to dryness. The Midwest is of greatest concern with substantial areas of winter sown crops already lost and the quality of much spring planted in doubt.

China’s wheat crop appears to have been badly impacted by storms.

Although there are no official indications as to the scale of damage there are rumours that up to 20MMT of wheat have been lost or reduced in quality. It is, therefore, likely that China will continue to buy milling grade wheat. There are already indications that its purchase of animal feed is slowing, which may indicate that they will switch to poorer grade domestic wheat in the short term.

India has announced that it may cut wheat import duty if needed as harvest figures are indicating a second year of low production, this could impact Government efforts to curb food inflation. India has already stopped wheat exports, except for certain government to government trades in an effort to restock its strategic reserve and keep domestic prices down.

Romanian officials are considering measures to give local farmers priority access to the port of Constanta during the harvest season, which could restrict the flow of Ukrainian grain. In addition, Hungary is pushing for a further ban on the import of certain agricultural products from Ukraine to neighbouring countries.

In further bad news for Ukraine, the continuation of the Black Sea Grain initiative, under which it exports the bulk of Ukrainian grain, looks to be in doubt after the UN told Russia its grievances cannot be dealt with.

The north, northwest and the central areas of Poland are reportingly suffering from heat and dryness though crops in the south look good. It is thought The Polish wheat crop could fall to 12.0-12.2 MMT, down five to six per cent from last year.

The Polish Government has begun buying domestic grain surplus in a controversial move to support their farmers, citing cheap Ukrainian wheat as a negative factor in the market.

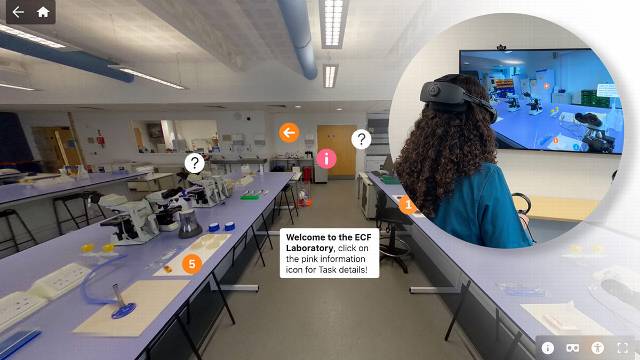

Blog: Veterinary Medicine students step into immersive 360° laboratory

At Harper & Keele Veterinary School, students are stepping beyond the traditional microbiology bench and into an immersive 360° labo …

Posted

Yesterday

Blog: Veterinary Medicine students step into immersive 360° laboratory

At Harper & Keele Veterinary School, students are stepping beyond the traditional microbiology bench and into an immersive 360° labo …

Posted

Yesterday