With forward thinking students studying for a degree that matters, it is not surprising that our academic staff are keen to understand the future of the sector too. Caring for the planet and it's precious resources is of great importance to what we do; you can find out more about our mission at our Virtual Open Day on June 17.

Here, Dr James Bell and and Alastair Boot, Senior Lecturers in the Department of Food Technology and Innovation, reflect on the impact of Covid-19 on the UK food retail sector and its implications for enterprises with a local focus.

As consumers we have grown accustomed to the benefits offered by our biggest food retailers, but Covid-19 has exposed their vulnerabilities.

Some early panic buying and the shut-down of the food service sector has created a huge spike in demand. Competitive pressures had seen the development of a highly sophisticated and lean supply chain; a model that fits well in a high-volume environment with stable demand patterns. For example, at the leading edge this has seen innovations such as artificially intelligent inventory systems – it is really clever until the assumptions of the world on which they are based, disappear.

Similarly, the vulnerability of a supply chain that extends across the globe has been exposed by the current crisis. The retail store is still the most likely purchase channel but is now regarded as less safe. This is very painful for our large-scale food retailers who have a huge investment in store-based retail. Developing and managing safe retail spaces for staff and customers will require even more investment.

Consumers have been sending conflicting messages for a few years now. “We want low price!” and “We want premium!”; “We want speed and convenience!” and “We want experience!”. This diversity - even within the habits of individual consumers based on specific missions - will not be changed by Covid-19 but the underlying trend will accelerate.

Consumers will want a keen price for everyday items because recession impacts jobs, earnings and confidence. They will want occasional indulgence in their groceries because they will eat out less frequently. Their desire for grocery deliveries or ‘click and collect’ already existed.

Pre-lockdown, online represented about 7% of the total grocery market in the UK, but growth had slowed. Covid-19 has provided a boost with many shoppers trying it out for the first time, and with current estimates suggesting that the online share of grocery sales has almost doubled. This will grow further with consumers expecting similar services from retailers, both large and small. Despite the expense and complexity for retailers of online shopping and delivery, resistance is futile.

Supermarkets were already competing hard in a low margin sector and already reducing costs and simplifying their operation to survive. In order for retailers to continue to reduce costs, the narrowing of product choice (“range rationalisation”) will continue. Another reason for reduced choice will be the added expense of imported goods so demand for seasonal goods will rise further.

The combination of higher demand for online shopping and reduced assortments will push retailers to continue re-purposing their space. Expect to lose chunks of your supermarket; smartly boarded-off and hiding micro-fulfilment centres servicing the even bigger delivery operation. For the supermarket operators offering nationwide service, online sales needed a boost from pre-lockdown levels to achieve viability.

In the post-banking-crisis recession of 2008, not only did consumers fall in love with discounters Aldi and Lidl, they also shopped more at M&S and Waitrose, leaving the mass market retailers struggling and “stuck in the middle”. We think that the sector has changed and that this will not happen again. The premium own brands of the discounters and the mass market supermarkets have expanded since 2008 so there is more choice for the consumer.

During the last recession, retailers decreased their investment in own-brand product development, preferring to pay for manufacturers to take this risk. We predict we will see this adjustment again. There will still be demand for new product development to help competing retailers stand apart and, to be successful, manufacturers need to build relationships with and understand their retail customers. Again, no change there!

Pre-Covid-19, local and alternative systems of food supply enjoyed attention for their potential to be more environmentally sustainable than the prevailing big food marketing set-up. Under lockdown, we as consumers have had ample opportunity to pause and reflect on the impact of our behaviour on the planet. There may have been other motivations to engage with local food, but this has presented the retailer with a great chance to showcase their green credentials. Consumers’ heightened perceptions of local food value based on sustainability, healthy living and having a safe place to shop represent an opportunity of the moment.

Covid-19 brought a surge in demand at local retailers and farm shops. Because this was partly pragmatism on behalf of shoppers who could not get what they wanted in panic-hit supermarkets, we argue that the trend will not continue unassisted. The assistance it requires is clarity of purpose, target, and communications.

The other interpretation of local is local produce. There is a window of opportunity for British producers to recapture the hearts of consumers but, for the opportunity to last, producers should still assume that being British alone is not enough. Retailers’ current courting of British farmers is borne of pragmatism rather than a change in philosophy. Farmers and producers should keep consolidating their businesses for long-term strength and for both local retail and local produce - the benefits must be crystal clear.

In line with the Harper Adams vision, our hearts are with students and rural industry. So, to conclude, we consider the implications of retail and consumer changes on student prospects and diversified farms. The UK food industry in the widest sense will continue to offer fantastic careers for graduates. All students leaving Harper after qualification will have a degree that matters.

For the farm shop entrepreneur, we recommend;

- Keep focus on the long term without being distracted by immediate and possibly expensive changes unless they have long term advantage.

- Get to know your new customers and what they want so that you can keep them after Covid-19. Remember that the service you offer is what makes you better than the competition.

- Be clear on what you stand for and communicate to new and established customers why it is in their interests to stay.

- Promote your safe, healthy and environmentally friendly credentials

- Make the most of technology to improve service delivery. This means your online capability and wider innovations such as contactless payment.

To read more about the impact Covid-19 has had on Harper life and how we are working to support those in need, click here.

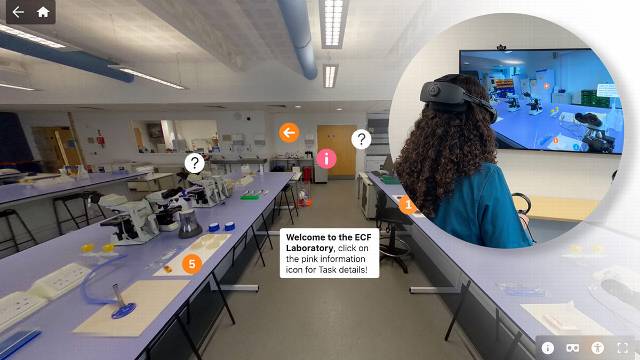

Blog: Veterinary Medicine students step into immersive 360° laboratory

At Harper & Keele Veterinary School, students are stepping beyond the traditional microbiology bench and into an immersive 360° labo …

Posted

Yesterday

Blog: Veterinary Medicine students step into immersive 360° laboratory

At Harper & Keele Veterinary School, students are stepping beyond the traditional microbiology bench and into an immersive 360° labo …

Posted

Yesterday